EV Company News For The Month Of April 2020

EV market news – Morningstar forecasts by 2030, half of all new auto sales globally will be electrified in some form.

China reduces subsidies YoY through to 2022 by 10% each year; stricter rules on range requirements favor NCM or NCA over LFP cathodes.

EV company news – Tesla Cybertruck pre-orders soar to over 600,000. Renault stops making gas cars in China. Kia to invest $25b; 11 new Kia EVs by 2025.

I do much more than just articles at Trend Investing: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Welcome to the April 2020 edition of Electric Vehicle (EV) company news.

The big news this month was the COVID-19 disruption. Despite this, global EV sales were solid mostly due to another great result from Europe, and China starting to recover. Perhaps the surprise for March was Tesla Model 3 outselling all other models by a factor of over 9 fold.

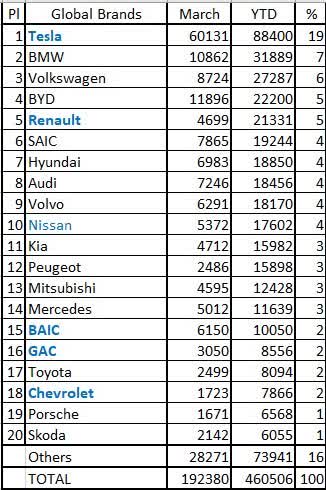

Global electric car sales as of end March 2020

Global electric car sales finished March 2020 with 192,000 (up on Feb. 116,000) for the month, down 15% on March 2019, with market share 2.5% for March 2020 and 2.0% YTD.

Of note 74% of all global electric car sales in March 2020 were 100% battery electric vehicles (BEVs), the balance being hybrids.

China electric car sales were ~60,000 in March 2020, down 51% on March 2019. Electric car market share in China for March was 5.7% and 4.2% YTD.

On March 31, 2020, China extended the subsidies for two years. Then in April 2020, subsidies were announced to decline by 10%pa through to 2022. The China’s Zero Emission Vehicle credit system (NEV credit scheme) in 2020 required 12 points of credits from new energy vehicles (NEVs). It is currently under consideration to be increased (14 in 2021, 16 in 2022 and 18 in 2023). A December 2019 report from Reuters stated: “China wants new energy vehicle sales in 2025 to be 25% of all car sales.“

Europe electric car sales were 84,000 in March 2020, 41% higher than in March 2019. Europe electric car market share was 9.9% in March and 7.5% YTD. Norway still leads the world with an incredible 75% market share in March 2020.

US electric car sales were not reported by EV Sales in March 2020 as it appears many ICE brands don’t want to publish their EV sales numbers.

Note: The above sales include light commercial vehicles.

Note: An acknowledgement to Jose Pontes of EV Sales and EV Volumes for his excellent work compiling all the electric car sales quoted above and below.

Global electric car sales by manufacturer for March 2020

Source: EV-Sales Blogspot

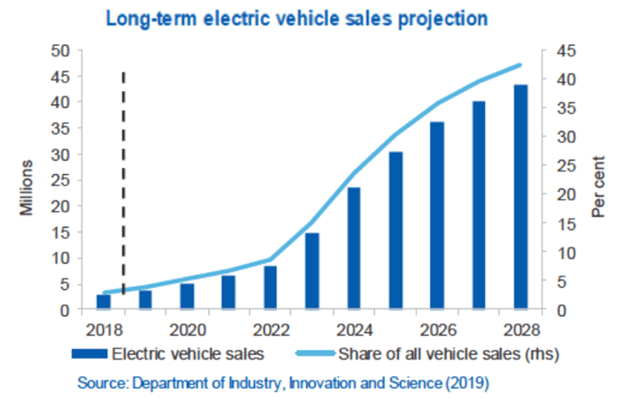

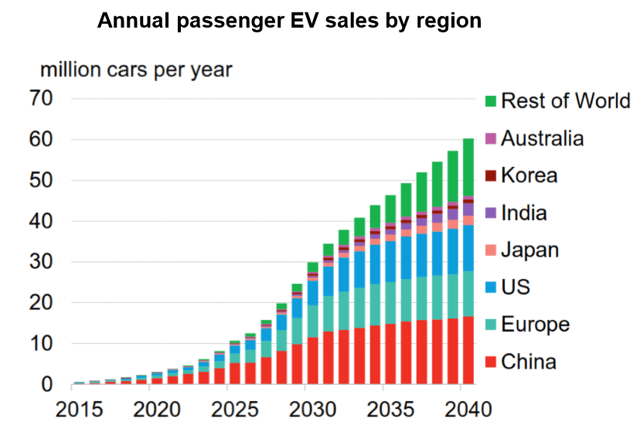

EV sales forecast to really take off from 2022 as affordability kicks in

The chart below aligns with my research that electric car sales will really take off after 2022, when my model forecasts electric and ICE car price parity.

Bloomberg’s forecast for annual electric vehicle sales is 10m by 2025, 28m by 2030, and 56m by 2040. A similar forecast is shown below.

Source: Bloomberg NEF 2019 Electric Vehicle Outlook

A similar forecast is shown below.

EV market news for April 2020

On April 9, the Robb Report reported: The first all-electric air taxi service is launching in LA next year. Quantum Air plans to be the world’s first electric air commercial operator when it opens an LA-based UAM network in 2021…The company says the eFlyer 2 costs $23 per flight hour to operate compared to $110 per hour for the Cessna 172, while maintenance costs for the electric engines are also much lower.

Quantum Air plans to be the world’s first electric air commercial operator with its eFlyer 2

Quantum Air’s eVTOL

On April 21 MetalTechNews reported:

Electric vehicles power lithium demand. In early phases of once-in-a-century demand transformation. The sharp rise in the need for lithium largely mirrors the Morningstar’s forecasted growth in fully electric and hybrid vehicles. “By 2030, we forecast half of all new auto sales globally will be electrified in some form,” the research firm wrote. The advisor sees the sharpest increases in EV sales after 2025, when it expects the costs and convenience of owning and fueling an EV to be on par with internal combustion engine vehicles.

On April 21 Electrek reported: “Tesla Model 3 fleet is delivered to Thai police who turns them into patrol cars.”

On April 24 Mining.com reported:

New China EV incentives fresh boost for cobalt, lithium price. Under the modified policy, subsidies are reduced year-on-year through to 2022, starting at a 10% cut this year. While at first blush this may be a negative, BMO Capital Markets points out that “there is now an incentive for buyers to bring forward their purchase, whereas previously they may have delayed, supporting both lithium and cobalt markets”. Another positive for cobalt and nickel prices are rules announced by the finance ministry to raise the requirements for the driving range and energy intensity of vehicles in order to qualify for the subsidies. More stringent range requirements favour batteries with NCM (nickel-cobalt-manganese) or NCA (nickel-cobalt-aluminum) cathodes over LFP (lithium-iron-phosphate) which while substantially cheaper, are bigger and heavier and offer lower range…..subsidies will only apply to passenger cars costing less than 300,000 yuan ($42,376). China has set a target for NEVs to account for a fifth of overall car and truck sales by 2025, compared with the current level below 5%. The EV industry is a pillar of the ruling communist party’s controversial Made in China 2025 program to dominate hi-tech fields globally.

On April 28 New Mobility News reported:

Europe readies massive plan to save auto industry. European Commissioner for Internal Market, Thierry Breton, estimates that Europe should dedicate 10% of its theoretical 1 500 billion euro economic stimulus measures to the automotive sector.

EV company news

Tesla Inc. (NASDAQ:TSLA)

Tesla is currently ranked the number 1 globally with 19% global market share. Tesla is number 1 in Europe with 12% market share, and number 2 in China with 14% market share. Tesla is still assumed to be the number 1 electric car seller in the US.

On April 2 Inside EVs reported:

Tesla Cybertruck pre-orders soar to over 600,000. Even more amazing is perhaps that new pre-orders are still coming in at a pace of around 1,000 per day, that’s despite these uncertain times amid the COVID-19 outbreak.

On April 2 Car Buzz reported: “Tesla Cybertruck is being completely redesigned. Safety concerns have prompted Tesla to rethink the Cybertruck’s design.”

An early render gives us a preview of the redesigned Cybertruck

On April 13, Green Car Reports reported: “Tesla sales took 30% of China’s EV market in March.”

On April 14 Seeking Alpha reported:

Goldman Sachs a believer in Tesla. “We are positive on Tesla because we believe that the company has a significant product lead in EVs, which is a market where we expect long-term secular growth,” notes Goldman Sachs analyst Mark Delaney. Delaney points to the combination of Tesla’s product leadership and early mover advantage. He also sees the Model Y helping Tesla to have more traction in the important SUV and crossover market with the price set to be lower than the Model X. Goldman assigns a price target of $864 on Tesla in its return to coverage.

On April 15, Green Car Reports reported:

Amid pandemic, cities woo Tesla over Cybertruck factory possibility….. Joplin, Missouri, has offered a $1 billion incentive package to Tesla, with the hope that a factory will add 7,000 jobs, reported The Joplin Globe.

On April 17, Electrek reported:

Tesla completes massive expansion of its ‘world’s biggest battery’. Tesla and Neoen, the owner of the Tesla Powerpack farm in Australia that has been described as the “world’s biggest battery”, have completed a massive expansion of the big battery system. The 100 MW/129 MWh Tesla Powerpack project in South Australia provides the same grid services as peaker plants, but cheaper, quicker, and with zero emissions through its battery system. It has proven so efficient that it reportedly should have made around $1 million in just a few days in January of 2019….

The 100 MW/129 MWh Neoen “Hornsdale Battery” in South Australia

On April 27, Electrek reported: “Tesla delays return of Fremont factory workers amid shutdown extension.”

On April 27, Electrek reported: “Tesla doubles down on claim Chinese EV startup stole its Autopilot source code.”

On April 29 CNBC reported: “Tesla delays Semi production and deliveries until 2021.”

On April 29 Seeking Alpha reported (full results are here):

Tesla EPS beats by $1.45, beats on revenue. Q1 Non-GAAP EPS of $1.24 beats by $1.45; GAAP EPS of $0.09 beats by $1.75. Revenue of $5.99B (+31.9% Y/Y) beats by $140M. Tesla says it produced 102,672 vehicles and delivered 88,496 vehicles to mark its best Q1 ever. Automotive gross margin came in at 25.5% of sales vs. 22.5% in Q4 and 20.2% a year ago.

Investors can read my June 2019 Blog post: “Tesla – A Look At The Positives And The Negatives”, where I rated the stock a buy. It was trading at USD 196.80.

BMW (OTCPK:BMWYY), Mini

BMW is currently ranked the number 2 global electric car manufacturer with 7% global market share. BMW is number 2 in Europe with 10% market share.

On April 3, Electrek reported:

BMW starts construction of China plant, where all-electric 3-Series is planned. BMW’s majority-owned Chinese company, BMW-Brilliance, began construction this week of a 3.2-square-kilometer plant. The expanded facility will help BMW produce 150,000 EVs a year in China.

Volkswagen Group [Xetra:VOW] (OTCPK:VWAGY) (OTCPK:VLKAF)/ Audi (OTCPK:AUDVF)/ Lamborghini/ Porsche (OTCPK:POAHF)/ Skoda

Volkswagen is currently ranked the number 3 top-selling global electric car manufacturer with 6% market share, and number 3 in Europe with 9% market share.

On April 2, Electrek reported:

Audi decides against all-electric version of its A8 flagship sedan…..Instead, the German luxury brand will equip the A8 with a plug-in hybrid with about 30 miles of electric range.

On April 17, Green Car Reports reported:

Porsche Taycan 4S has arrived in the US—with the longest range of the lineup…..The Taycan 4S with the Performance Battery Pack starts at $110,720. Porsche can deliver the Taycan in person “where it’s feasible to do so,” but elsewhere it’s offering a contactless home delivery service in which customers don’t even have to leave the house.

2020 Porsche Taycan 4S first drive – Los Angeles, CA

On April 24, Green Car Reports reported: “Lower-price Porsche Taycan is coming, with rear-wheel drive—and possibly better range.”

BYD Co. (OTCPK:BYDDY) (OTCPK:OTCPK:BYDDF) HK:1211

BYD is currently ranked the number 4 globally with 5% global market share and is ranked number 1 in China with 17% market share.

On March 30 Inside EVs reported:

BYD reveals ultra-safe blade battery: Pierces it with a nail. BYD Blade Battery leverages safety and improves volumetric energy density. Blade Battery will debut in the BYD Han (June 2020). The Blade Battery is essentially a lithium iron phosphate (LFP) battery, but in a new approach to significantly increase safety and volumetric energy density as well as reduce costs. To improve the batteries, BYD changed the conventional prismatic LFP cells into thinner and longer cells, which were designed to become structural parts (beams) of the pack. That simplifies the pack design.

On April 2, BYD reported:

BYD, Toyota launch BYD Toyota EV Technology Joint Venture to conduct battery electric vehicle R&D.

On April 23, BYD reported:

BYD and Hino sign a strategic business alliance agreement with a focus on Commercial Battery Electric Vehicles development.

Renault (OTC:RNSDF)/ Nissan (OTCPK:NSANY)/ Mitsubishi (OTCPK:MSBHY) (OTCPK:MMTOF)

Renault is ranked global number 5 globally with 5% market share and is currently number 4 in Europe with 9% market share. Nissan is currently ranked number 10 for global electric car sales with 4% market share

On April 14 Electrek reported:

Renault stops making gas cars in China, shifting sales only to electric cars. But the French automaker will retain its interest in three different ventures to produce multiple electric vehicles in the world’s largest auto market and for export. Renault launched its K-ZE all-electric city car in China in 2019. The car is produced by eGT New Energy Automotive Co., the joint venture with Nissan and Dongfeng in which Renault has a 25% stake. Renault will also develop four EVs…..with Jiangxi Jiangling Group Electric Vehicle (JMEV). And it will retain a 49% stake in a venture with Brilliance Auto Group to make all-electric light commercial vehicles.

Investors can read my recent Trend Investing article: “The Era Of The Truly Affordable Electric Car Is Finally Arriving Soon Helped By Renault.”

Beijing Automotive Group Co. (BAIC) [HK:1958) (OTC:BCCMY), SAIC Motor Corporation Limited [SAIC] [CH:600104] (SAIC includes Roewe, MG, Baojun, Maxus)

BAIC is currently ranked the global number 15 with 2% market share.

SAIC is global number 6 with 4% market share, and number 3 in China with 12% market share.

On April 27, Automotive News China reported:

SAIC earmarks 3.3 billion yuan for incentives to boost Roewe sales. In addition to those five vehicles — the i5 and i6 Plus sedans and the RX3, RX5 and RX8 crossovers — SAIC builds and markets plug-in hybrid and electric vehicles under the Roewe and MG brands.

Hyundai (OTC:HYMTF) Kia (OTC:KIMTF)

Hyundai is currently ranked number 7 for global electric car sales with 4% market share. Kia is ranked global number 11 and has 3% market share.

On April 3, Green Car Reports reported: “Future Hyundai electric cars might clean the air while they charge.”

On April 6, Electrek reported:

Hyundai’s latest EV concept is a visual mash-up of Model 3, Porsche 911, and Mercedes EQS. Hyundai did a digital reveal of its Prophecy EV concept last month. Now the company says the model is more than a concept. According to Hyundai, the Prophecy is a showcase of vehicle features that will be offered in the not-too-distant future.

Hyundai Prophecy concept

On April 9, Green Car Reports reported:

Electrify America offering discounted pricing for Kia Niro EV drivers. Kia is the latest automaker to partner with a charging network on discounted rates for drivers of its electric cars.

On April 24, Green Car Reports reported:

Kia electric car: 300-mile range, 20-minute fast-charging, arriving by late 2021. With Kia’s Plan S, revealed in January, the South Korean brand became much more committed about going electric and committing to a significant volume of electric vehicles in the future. Under the plan, Kia will invest $25 billion by the end of 2025, with global aims to introduce 11 new Kia EVs by 2025 and sell 500,000 electric vehicles annually by that year. With that, Kia would have a projected 6.6% of the world’s electric vehicle sales. And in the years between now and then it plans to add plug-in hybrid models and mobility ventures.

Kia HabaNiro concept

Geely Automobile Holdings Ltd (OTCPK:GELYY) [HK:0175] (includes Polestar), Volvo Group (OTCPK:VOLVY), Kandi Technologies Group (NASDAQ:KNDI), Proton, Lotus

Volvo is currently ranked number 9 in the global electric car manufacturer’s sales ranking with 4% global market share.

On March 30, Geely Automobile Holdings Ltd. announced:

Geely Automobile Holdings Limited announced annual results for the year ended 31 December 2019 profit attributable to shareholders decreased by 35% to 8.2billion. The Spokesmen of Geely Automobile said, “Given the prevailing uncertainties in China’s passenger vehicle market, the Group’s board of directors preliminarily set the Group’s sales volume target for the year of 2020 at 1,410,000 units (including the sales volume target for “Lynk&Co” vehicles), representing an increase of around 4% from the total sales volume achieved in 2019.”

On April 8, CarSales reported:

2022 Polestar 3 will be based on Precept concept. Swedish EV car-maker says sleek new SUV coupe will rival both the Jaguar I-PACE and Tesla

2022 Polestar 3

On April 13, GlobeNewswire reported:

Geely-Kandi affiliate Fengsheng automotive introduces pure electric SUV Maple 30X.

On April 14, The Driven reported: “Volvo delays Australian launch of Polestar 2 EV and XC40 plug-in”

Group PSA – Peugeot SA [FR:UG] [PA:PEUP] (OTCPK:PEUGF) (OTCPK:PEUGY)/Citroen, Fiat Chrysler (NYSE:FCAU)

Peugeot is ranked global number 12 globally with 3% market share.

Daimler-Mercedes (OTCPK:DDAIF) (Smart – 50% JV between Daimler & Geely)

Mercedes is ranked global number 14 globally with 3% market share.

On April 6, Electrek reported: “Green light for Mercedes-Benz EQS AMG sedan, a 600hp electric luxury beast.”

On April 7, Green Car Reports reported: “Mercedes-AMG EQS electric fastback could challenge Tesla Model S Plaid, Porsche Taycan.”

Mercedes-Benz Vision EQS concept

Toyota (NYSE:TM) Lexus

On April 7, IEEFA.org reported:

Toyota teams up with Chubu Electric to enter renewable energy market in Japan…..The automotive giant said that it aspires to move toward a society where people, automobiles, and nature can coexist in harmony.

General Motors/Chevrolet (NYSE:GM)

On April 2, GM reported: “General Motors and Honda to jointly develop next-generation Honda electric vehicles powered by GM’s ultium batteries.”

On April 20, GM reported:

General Motors and DTE Energy are making Michigan a clean energy powerhouse….”GM and DTE Energy partner on state’s largest renewable energy investment.

Ford (NYSE:F)

On March 30, The Detroit News reported:

Mustang Mach-E development doesn’t stop for coronavirus. Ford Motor Co. engineers are keeping the Mustang Mach-E program on track to launch this fall even as the coronavirus pandemic disrupts manufacturing, sales and other business.

On April 23, Electric Vehicle News reported: “Ford first factory fully electric Dragster – Mustang Cobra Jet 1400.”

Mustang Cobra Jet 1400

Mazda (OTCPK:MZDAY)

On April 10 Car Advice reported:

Mazda MX-30 electric SUV to introduce rotary-powered range extender (in 2020)……The test vehicle was equipped with the Rotary extender that boosted its total range by 180km. Specifically, it lifted it from 200km as an electric-only proposition, up to 380km with dual motors.

Rivian Automotive (private)

On April 6, The Chicago tribune reported:

Electric truck startup Rivian pushes launch back to 2021 as COVID-19 delays Normal factory retooling……Rivian had planned to make the first deliveries of preordered trucks and SUVs this year. The temporary shutdown of the facility has delayed construction at the plant, and the launch date. “It will be 2021,” Rivian spokeswoman Amy Mast said Monday.

NIO, Inc. (formerly NextEV) (NIO)

On April 22, Green Car Congress reported:

NIO begins delivery of updated ES8 smart electric flagship SUV. NIO has officially started deliveries of its 2020 ES8, the flagship model from its smart electric vehicle range. As of 31 March 2020, with cumulative deliveries of 20,675, the ES8 was the only Chinese model in the top ten sales chart for the luxury SUV class.

ES8 Smart Electric Flagship SUV

Fisker (private)

On April 8, The Driven reported:

Fisker teases “extreme” off-road version of electric Ocean SUV…..that, if produced, would be aimed at emergency and military services.

Electric Fisker Ocean SUV

On April 13, Fisker reported:

Fisker Ocean launch on target and additional off-road option package. Fisker Inc. is gearing up for the final phase of development, tooling and commercialization of its first vehicle, the all-electric Fisker Ocean. Over 22,000 people from 116 countries have shown interest in the 2022 Fisker Ocean EV, with majority of paid reservations coming from North America. The Fisker Ocean is on target to enter production end of next year [2021], starting high volume ramp up and deliveries in second half of 2022.

Lucid Motors (formerly Atieva) (private)

On April 2, Green Car Reports reported:

Lucid Air electric sedan prototype covers 400+ highway miles, company teases. Lucid CEO Peter Rawlinson told Green Car Reports earlier this year that its upcoming Lucid Air electric sedan will achieve not just a 400-mile EPA range rating but 400 miles at highway speed – a number that no other current electric car can reasonably today meet, including the Tesla Model S.

Nikola Corporation (private)

On April 22, CleanTechnica reported:

Nikola Motors shoots for the moon with 5 new electric vehicles — #CleanTechnica Field Trip. Nikola Motor Company blew up the world of zero-emission vehicles last week with the announcement of five new vehicles, ranging from its battery and hydrogen fuel cell electric trucks to a new electric personal watercraft.

Byton (private)

On April 15, Green Car Reports reported:

Byton M-Byte ramping up at China plant, still on track for 2021 US arrival. Pre-production examples of the Byton M-Byte electric crossover have begun rolling off the assembly line at the startup’s Nanjing, China, factory, the company confirmed on Tuesday. Byton plans to launch the M-Byte in China later this year, and reports that it resumed activity at the plant on February 11……plans are moving along for U.S. production to come from this same plant in the latter part of 2021.

Byton M-Byte – pre-production

On April 23, South China Morning Post reported: “Chinese EV start-up Byton furloughs staff, cuts pay as pandemic casts doubt on first car delivery.”

Xpeng Motors

On April 27 Bloomberg reported:

China’s Xpeng unveils car with longer range than Tesla’s Model 3. The P7 sedan, Guangzhou-based Xpeng’s second vehicle, will have a maximum range of 706 kilometers (440 miles) per charge and cost 254,900 yuan ($36,000) after subsidies when it becomes available in September, the company said Monday. By comparison, the longer-range version of the Model 3 that’s expected to be available in China in June will be able to run 650 kilometers on one charge and sell for 344,050 yuan.

Xpeng P7 sedan

Other EV companies

Other EV companies I am following include Atlis Motor Vehicles, Inc., Chery Automobile Co. Ltd. (private), Didi Chuxing (DIDI), Dyson (private), Electrameccanica Vehicles Corp. (SOLO), Faraday Future (private), Great Wall Motors, GreenPower Motor Company Inc. [TSXV:GPV] (OTCQX:GPVRF), Guangzhou Automobile Group Co., Honda (NYSE:HMC) (OTCPK:HNDAF), Mahindra & Mahindra (OTC:MAHDY), Qiantu Motor, Subaru (OTCPK:FUJHY), Suzuki Motor Corp. [TYO: 7269] (OTCPK:SZKMY) (OTCPK:SZKMF), Tata Motors (TTM) group (Jaguar, Land Rover), WM Motor, Xiaopeng Motors, and Zhi Dou (private).

The list of countries and cities banning (or planning to ban) petrol and diesel vehicles include at least – Norway (2025), Netherlands (2030), China (?25% EVs by 2025), Germany (?2030), Hong Kong (2030-40), Ireland (2030), Israel (2030), India (30% by 2030), Scotland (2032), UK (2035), France (2040), Taiwan (2040), Singapore (2040), Japan (2050); Rome (2024), Athens (2025), Paris (2025), London, Stuttgart, Mexico City (2025), Madrid (2025), and Amsterdam and Brussels (2030).

Autonomous Driving/Connectivity/Onboard entertainment/Ride sharing

On April 28 VentureBeat reported:

The challenges of developing autonomous vehicles during a pandemic. In March, many high-profile startups and spinoffs, including Uber, Cruise, Aurora, Argo AI, and Lyft, suspended real-world testing of their autonomous vehicle fleets, citing safety concerns and a desire to limit contact between drivers and riders. Waymo went one step further, announcing that it would pause its commercial Waymo One operations in Phoenix, Arizona – including its fully driverless cars, which don’t require human operators behind the wheel – until further notice.

On April 29 TechCrunch reported: “Ford postpones autonomous vehicle service until 2022.”

Conclusion

March 2020 global electric car sales were 192,000, down 15% YoY, with 2.5% global market share. Electric car market share for March reached 5.7% in China, 9.9% in Europe, and no updated figures for the USA.

Highlights for the month were:

- Morningstar forecasts: “By 2030, we forecast half of all new auto sales globally will be electrified in some form.”

- The first all-electric air taxi service is launching in LA next year.

- New China EV incentives. Under the modified policy, subsidies are reduced YoY through to 2022, starting at a 10% cut this year. More stringent range requirements favour batteries with NCM or NCA cathodes over LFP. Subsidies will only apply to passenger cars costing less than 300,000 yuan ($42,376).

- Tesla Cybertruck being re-designed, pre-orders soar to over 600,000. Goldman Sachs a believer in Tesla (PT of $864). Tesla completes massive expansion of its “world’s biggest battery”. Tesla says it produced 102,672 vehicles and delivered 88,496 vehicles to mark its best Q1 ever, Q1 beats on profit and revenue.

- BMW starts construction of China plant with capacity to build 150,000 EVs pa.

- BYD reveals a new higher density, safer, LFP “blade” battery. BYD and Toyota launch a new EV Technology JV.

- Renault announced it would stop making and selling gas-powered cars in China.

- SAIC earmarks 3.3 billion yuan for incentives to boost Roewe sales.

- Kia will invest $25 billion by the end of 2025, with global aims to introduce 11 new Kia EVs by 2025 and sell 500,000 electric vehicles pa by 2025.

- Green light for Mercedes-Benz EQS AMG sedan, a 600hp electric luxury beast.

- General Motors and Honda to jointly develop next-generation Honda electric vehicles powered by GM’s ultium batteries.

- Mazda MX-30 electric SUV to introduce rotary-powered range extender (in 2020), up to 380km with dual motors.

- Electric truck startup Rivian pushes launch back to 2021 as COVID-19 delays normal factory retooling.

- NIO begins delivery of updated ES8 smart electric flagship SUV.

- Lucid Air electric sedan prototype covers 400+ highway miles.

- Nikola Motors shoots for the moon with 5 new electric vehicles.

- China’s Xpeng unveils car with longer range than Tesla’s Model 3, with a maximum range of 706 kilometers (440 miles).

- Several autonomous vehicle operations pause due to COVID-19.

Font: Seeking Alpha